Another job completed by Irish Jones Construction. Our construction team is not only for our investors. If you are looking to remodel a room in your home, reach out to Irish Jones and we will come give you a quote. #irishjones #wny #construction #weareyourteam

With everything going on in the world today you never know what to expect. Below is an article that talks about Mortgage rates and where they will go from here. Please take a read especially if you are looking into purchasing a house in the upcoming months. #knowledgeiskey #irishjones #mortgagerates #realty #housingmarket

What’s Happening with Mortgage Rates, and Where Will They Go from Here?

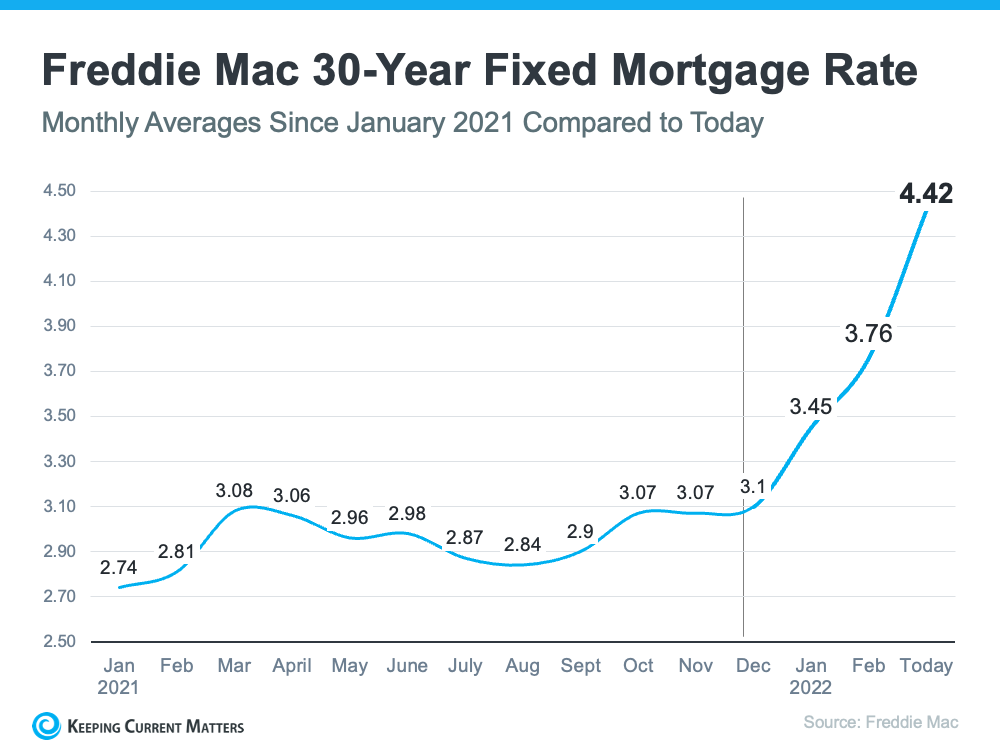

Based on the Primary Mortgage Market Survey from Freddie Mac, the average 30-year fixed-rate mortgage has increased by 1.2% (3.22% to 4.42%) since January of this year. The rate jumped by more than a quarter of a point from just a week ago. Here’s a visual to show how mortgage rate movement throughout 2021 was steady compared to the rapid increase in mortgage rates this year:

Just a few months ago, Freddie Mac projected mortgage rates would average 3.6% in 2022. Earlier this month, Fannie Mae forecast mortgage rates would average 3.8% in 2022. As the chart above shows, rates have already surpassed those projections.

Sam Khater, Chief Economist at Freddie Mac, explained in a press release last week:

“This week, the 30-year fixed-rate mortgage increased by more than a quarter of a percent as mortgage rates across all loan types continued to move up. Rising inflation, escalating geopolitical uncertainty and the Federal Reserve’s actions are driving rates higher and weakening consumers’ purchasing power.”

Where Are Mortgage Rates Going from Here?

In a recent article by Bankrate, several industry experts weighed in on where rates might be headed going forward. Here are some of their forecasts:

Greg McBride, Chief Financial Analyst, Bankrate:

“With inflation figures continuing to surprise to the upside, mortgage rates will remain above 4.0% on the 30-year fixed.”

Nadia Evangelou, Senior Economist and Director of Forecasting, National Association of Realtors (NAR):

“While higher short-term interest rates will push up mortgage rates, I expect some of this impact to be mitigated eventually through lower inflation. Thus, I expect the 30-year fixed mortgage rate to continue to rise, although we aren’t likely to see the big jumps that occurred over the past few weeks.”

Len Kiefer, Deputy Chief Economist, Freddie Mac:

“Mortgage rates are likely to continue to move higher throughout the balance of 2022, although the pace of rate increases is likely to moderate.”

In a recent realtor.com article, another expert adds to the conversation:

Danielle Hale, Chief Economist, realtor.com:

“. . . As markets digest the Fed’s updated economic projections, I anticipate a continued increase in mortgage rates over the next several months. . . .”

What Does This Mean for You if You’re Looking To Buy a Home?

With both mortgage rates and home values expected to increase throughout the year, it would be better to buy sooner rather than later if you’re able. That’s because it’ll cost you more the longer you wait. But, there is a possible silver lining to buying a home right now. While you’ll be paying a higher price and a higher mortgage rate than you would have last year, rising prices do have a long-term benefit once you buy.

If you purchase a home today valued at $400,000 and put 10% down, you would be taking out a $360,000 mortgage. According to mortgagecalculator.net, at a 4.42% fixed mortgage rate, your mortgage payment would be $1,807 a month (this does not include insurance, taxes, and other fees because those vary by location).

Now, let’s put that mortgage payment into a new perspective based on the substantial growth in equity that comes with the escalation in home prices. Every quarter, Pulsenomics surveys a panel of over 100 economists, investment strategists, and housing market analysts about their expectations for future home prices in the United States. Last week, Pulsenomics released their latest Home Price Expectation Survey. The survey reveals that the average of the experts’ forecasts calls for a 9% increase in home values in 2022.

Based on those projections, a $400,000 house you buy today could be valued at $436,000 by this time next year. If you break that down, that means the equity in your home would increase by $3,000 a month over that period. That’s greater than the estimated monthly payment above. Granted, the increase in your net worth is tied to the home, but it is one way to put the home price appreciation to use in a way that benefits you.

Bottom Line

Paying a higher price for a home and a higher mortgage rate can be a difficult pill to swallow. However, waiting will just cost you more. If you’re ready, willing, and able to buy a home, now will be a better time than a year, or even six months from now. Connect with a real estate professional to begin the process today.

This home needed some TLC. Irish Jones went in and made this old home look shiny and new. Updated flooring, fresh paint, new kitchen cabinets and updated lighting. Great Job guys! Our construction team is not only for our investors. If you need a job completed and you are looking for a great construction team reach out to Irish Jones! #irishjones #construction #wny #checkusout #notonlyforinvestors #irishjonesrealtypropertymanagementconstruction

Take a look at the article below. This information is really good information. For any investor this is another reason as to why investing in the housing market is a good idea. #invest #wny #irishjones #investorfocused

A Key To Building Wealth Is Homeownership By: KCM

The link between financial security and homeownership is especially important today as inflation rises. But many people may not realize just how much owning a home contributes to your overall net worth. As Leslie Rouda Smith, President of the National Association of Realtors (NAR), says:

“Homeownership is rewarding in so many ways and can serve as a vital component in achieving financial stability.”

Here are just a few reasons why, if you’re looking to increase your financial stability, homeownership is a worthwhile goal.

Owning a Home Is a Building Block for Financial Success

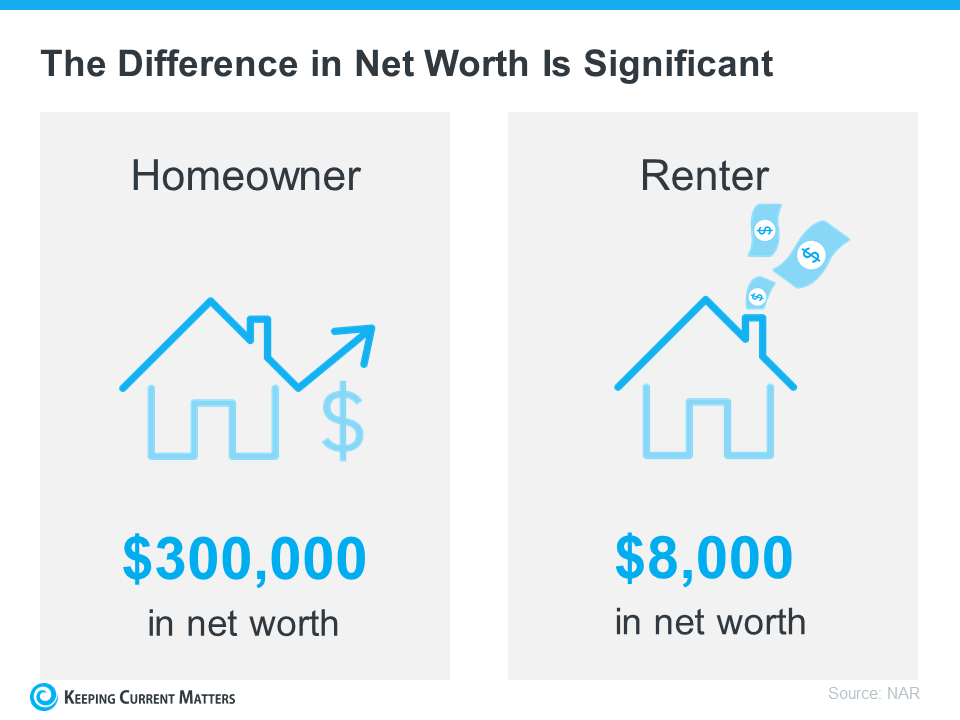

A recent NAR report details several homeownership trends and statistics, including the difference in net worth between homeowners and renters. It finds:

“. . . the net worth of a homeowner was about $300,000 while that of a renter’s was $8,000 in 2021.”

To put that into perspective, the average homeowner’s net worth is roughly 40 times that of a renter (see visual below):

The results from this report show that owning a home is a key piece to the puzzle when building your overall net worth.

Equity Gains Can Substantially Boost a Homeowner’s Net Worth

The net worth gap between owners and renters exists in large part because homeowners build equity. As a homeowner, your equity grows as your home appreciates in value and you make your mortgage payments each month.

In other words, when you own your home, you have the benefit of your mortgage payment acting as a contribution to a forced savings account. And when you sell, any equity you’ve built up comes back to you. As a renter, you’ll never see a return on the money you pay out in rent every month.

To sum it up, NAR says it simply:

“Homeownership has always been an important way to build wealth.”

Bottom Line

The gap between a homeowner’s net worth and a renter’s shows how truly foundational homeownership is to wealth-building. If you’re ready to start on your journey to homeownership, talk with a trusted real estate advisor today.

What You Can Expect from the Spring Housing Market By: KCM

As the spring housing market kicks off, you likely want to know what you can expect this season when it comes to buying or selling a house. While there are multiple factors causing some uncertainty, including the conflict overseas, rising inflation, and the first rate increase from the Federal Reserve in over three years — the housing market seems to be relatively immune.

Here’s a look at what experts say you can expect this spring.

1. Mortgage Rates Will Climb

Freddie Mac reports the 30-year fixed mortgage rate has increased by more than a full point in the past six months. And despite some mild fluctuation in recent weeks, experts believe rates will continue to edge up over the next 90 days. As Freddie Mac says:

“The Federal Reserve raising short-term rates and signaling further increases means mortgage rates should continue to rise over the course of the year.”

If you’re a first-time buyer or a seller thinking of moving to a home that better fits your needs, realize that waiting will likely mean you’ll pay a higher mortgage rate on your purchase. And that higher rate drives up your monthly payment and can really add up over the life of your loan.

2. Housing Inventory Will Increase

There may be some relief coming for buyers searching for a home to purchase. Realtor.com recently reported that the number of newly listed homes has grown for each of the last two months. Also, the National Association of Realtors (NAR) just announced the months’ supply of inventory increased for the first time in eight months. The inventory of existing homes usually grows every spring, and it seems, based on recent activity, the next 90 days could bring more listings to the market.

If you’re a buyer who has been frustrated with the limited supply of homes available for sale, it looks like you could find some relief this spring. However, be prepared to act quickly if you find the right home.

If you’re a seller, listing now instead of waiting for this additional competition to hit the market makes sense. Your leverage in any negotiation during the sale will be impacted as additional homes come to market.

3. Home Prices Will Rise

Prices are always determined by supply and demand. Though the number of homes entering the market is increasing, buyer demand remains very strong. As realtor.com explains in their most recent Housing Report:

“During the final two weeks of the month, more new sellers entered the market than during the same time last year. . . . However, with 5.8 million new homes missing from the market and millions of millennials at first-time buying ages, housing supply faces a long road to catching up with demand.”

What does that mean for you? With the demand for housing still outpacing supply, home prices will continue to appreciate. Many experts believe the level of appreciation will decelerate from the high double-digit levels we’ve seen over the last two years. That means prices will continue to climb, just at a more moderate pace. Most experts are predicting home prices will not depreciate.

Won’t Increasing Mortgage Rates Cause Home Prices To Fall?

While some people may believe a 1% increase in mortgage rates will impact demand so dramatically that home prices will have to fall, experts say otherwise. Doug Duncan, Senior Vice President and Chief Economist at Fannie Mae, says:

“What I will caution against is making the inference that interest rates have a direct impact on house prices. That is not true.”

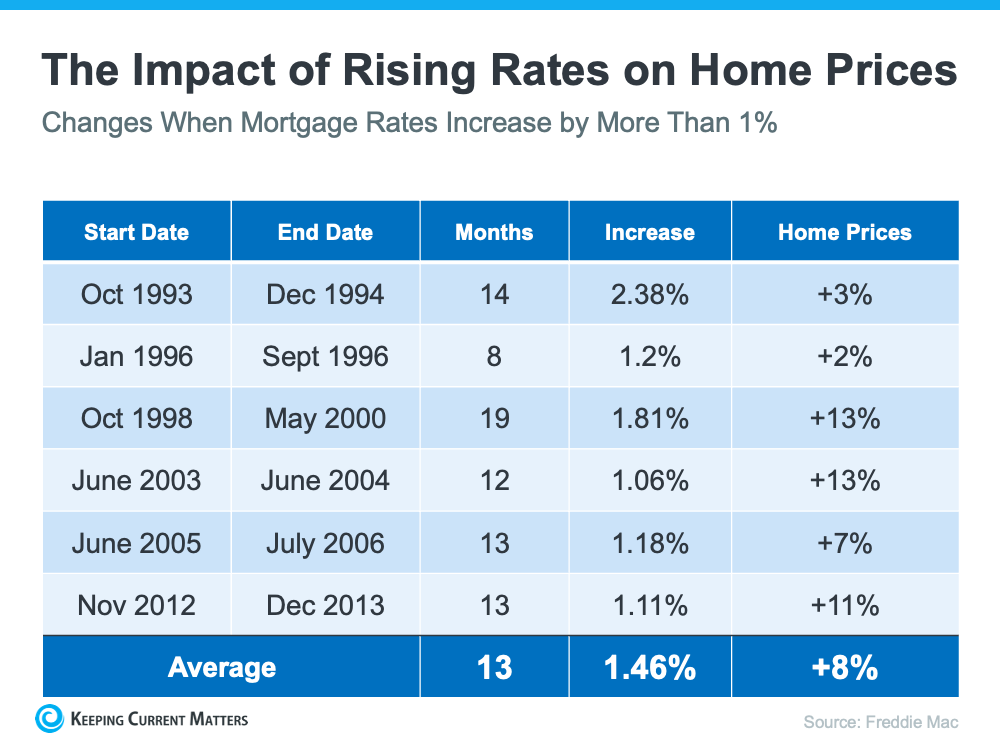

Freddie Mac studied the impact that mortgage rates increasing by at least 1% has had on home prices in the past. Here are the results of that study:

As the chart shows, mortgage rates jumped by at least 1% six times in the last thirty years. In each case, home values increased.

So again, if you’re a first-time buyer or a repeat buyer, waiting to buy likely means you’ll pay more for a home later in the year (as compared to its current value).

Bottom Line

There are three things that seem certain going into the spring housing market:

- Mortgage rates will continue to rise

- The selection of homes available for sale will modestly improve

- Home prices will continue to appreciate, just at a slightly slower pace

If you’re thinking of buying, act now before mortgage rates and home prices increase further. If you’re thinking of selling, your best bet may be to sell soon so you can beat the increase in competition that’s about to come to market.

Something for Tenants and Investors to know about. Attached we have the Lead Base Brochure link to review. Be aware and keep you family and tenants safe. #irishjonescares #investorandtenantknowledge #irishjonesrealtyandpropertymanagement

When buying rental properties real estate investors want to get a high return on investment. Irish Jones is here to help. Below is an article on how, as an investor, you can get a higher return on your investment when it comes to upgrades to your property! #irishjonesconstruction #durablenotexpensive #investorfocused #propertymanagement #realty

REAL ESTATE RENOVATION: HOW WILL IT AFFECT YOUR ROI?

Real estate investors are always looking for a high return on investment (ROI) when buying rental properties. Higher returns can be achieved and influenced in many ways. Real estate renovation is one of those ways.

Different real estate renovation projects offer different benefits. Determining which renovations to undertake for maximum return does depend on the property’s condition, but it also depends on what you plan to do with that property.

If you’re planning on buying an investment property to flip for a profit at resale, or you’re updating your current investment property to increase its value before putting it on the market, this blog could still benefit you. However, the main target of this blog on real estate renovation is those of you following a buy and hold real estate investment strategy.

Whether you’ve just realized it’s time to spruce up your current rental property, or you’re planning on investing in a fixer-upper to rent out after renovations, knowing how real estate renovation affects ROI is important. Let’s get into it.

Benefits of Real Estate Renovation

The main reason real estate investors choose to take on renovation or remodeling projects is simple: the potential long term return on investment. Renovated rental units justify a higher rental rate. However, there are a couple of other factors behind real estate renovation:

- To maintain or improve the value of the investment property through necessary repairs or replacements

- To increase equity

- Rental property improvements to attract better-qualified tenants

- Tax advantages

- Reduced maintenance

- Lower vacancy rates

Let’s find out why these factors are important to consider and how they affect ROI.

1) Increased Rent

This is the ultimate factor when determining future return on investment. How much more can you increase rents as a result of this real estate renovation and for how long? After all, every business expense has a cost and a benefit. Will these renovation costs make sense financially when looking at the long-term benefits?

It’s very important to think about how long it will take you to actually recover the cost of your renovations through the increased rental rate you can now achieve from your rental property.

2) Increased Value/Equity

Higher rent isn’t the only major effect real estate renovation has on ROI. Think about the increased equity you will have in your rental property after these improvements. For example, if you spent $5,000 on a kitchen renovation, your investment property’s value will increase by that amount or even more. One can even say this increased equity covers the renovation costs. Increased rent or increased value- either way, you’re looking at better cash flow and a better real estate investment.

3) High-Quality Tenants

It’s also important to consider your target tenant group before taking on real estate renovation projects for future rental properties. Newly improved rental units tend to attract more serious renters- renters who would appreciate these improvements and not recklessly damage any new installments.

You need to make sure your target tenant will actually be able to pay the higher rental rates. This is especially important when investing in rental properties that are already occupied. You’d need to go over the lease agreements and discuss the change in rental rate after real estate renovation.

4) Reduced Maintenance

This one’s pretty obvious. Depending on the condition of the current kitchen and bathroom appliances, maintenance and repairs could really build up a hefty expense. New appliances/upgrades mean fewer visits from maintenance. Real estate renovation could save you hundreds annually for the first couple of years. This is also true for electricity and plumbing; new sinks or toilets could go a long way. Lower annual expenses matched with higher annual rental income is a great booster for ROI.

5) Reduced Vacancy

Most people want to live in new and trendy homes. Putting a renovated rental property on the market won’t just allow you to charge premium rents, it’ll also help it get occupied quicker. The less time your rental property is vacant, the more money you save. An unoccupied rental isn’t doing anything for your returns.

Renovations for Higher Return on Investment

Now it’s important here to not “over-renovate.” Not every renovation will lead to an improved ROI. Real estate investors need to show restraint with the extent of their renovations; it’s not necessary to get the most expensive appliances or flooring for a rental property.

For example, custom-made cabinets or high-end faucets won’t really do anything for your cash on cash return and cap rate (two key measures of ROI). One doesn’t really have any added value to the tenant (unless it’s a luxury rental in which case it might) and the other just isn’t sustainable.

The point is, an extra renovation cost doesn’t necessarily mean it’ll reflect on your ROI. However, this doesn’t mean you should do whatever’s cheapest. It all comes down to durability and the aesthetic your target tenant desires. Here are some cost efficient and desirable renovations which offer substantial ROI for rental properties:

Deep Cleaning Interior/Exterior

Possibly the easiest and cheapest way to increase the appeal of your rental unit is to actually clean it. Thoroughly cleaning the interior could completely flip the property. The same goes for the exterior; pressure washing the outside grounds will give a fresher feel to the place.

Paint

Most fixer-uppers come with a dull paint-scheme. A fresh coat of paint of some welcoming colors will definitely help make the rental property look brand new.

Flooring

The floors in your rental property could give it a completely different feel. With so many different types and styles on the market, the choices are endless. Changing the floors to match the rest of the real estate renovation of your investment property will definitely pay off.

Kitchen and Bathrooms

Most of your real estate renovation budget will be spent on these two areas in the investment property. Whether you’re renting this property to tenants or putting it up for sale on the market, remodeling the kitchen and bathrooms is key. According to Realtor.com, kitchen and bath remodels offer nearly an 85% ROI. Even small improvements (resurfacing cabinets/tubs and refinishing cabinets) can make a big difference.

Windows/Doors

Having adequate doors and windows isn’t just important for the overall look of the investment property, but it’s also important for the safety. Jammed windows and creaky doors aren’t what tenants are looking for. Although doors are less expensive than windows, the final cost difference in updating both will be worth it.

Of course, the list of real estate renovation projects investors can take on is endless, but this is a great start for improving ROI.

Thinking of selling your home but not sure if this is the right time. Well, I would like to share an article that I think will help you make...

-

Thinking of selling your home but not sure if this is the right time. Well, I would like to share an article that I think will help you make...

-

Here is another home our agent helped our buyer close on. This home closed at $260,000. This is a nice addition to our clients investment ...

.jpg)